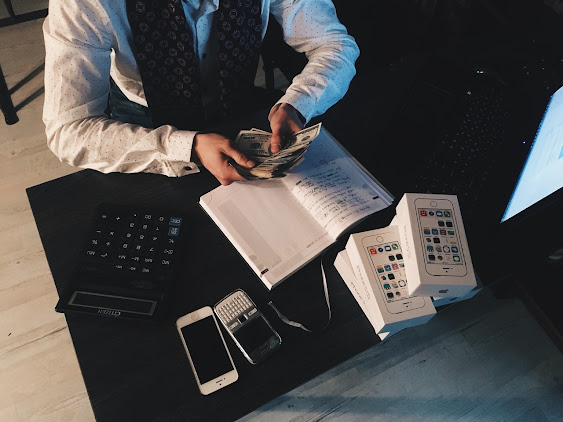

3 Ways to Keep Legitimate Assessment Records For Your Self-start venture

The last thing the vast majority contemplate while beginning a business is doing charges. In any case, legitimate arranging will make doing your charges a lot simpler - and keep the IRS cheerful! The following are 3 straightforward ways to keep appropriate records: 1. At the point when you purchase anything for your business, keep the receipt! Not exclusively will this make record keeping much more straightforward, but on the off chance that you are ever examined (having your assessment form surveyed exhaustively by the IRS), you can demonstrate your costs, and set aside your cash. 2. Record every one of your costs and pay as they occur. As your business develops, you'll have an ever-increasing number of exercises to keep you occupied. The last thing you'll believe that should do every April 15 is to arrange your records for the year. In this way, it's really smart to record all your monetary exercises as they occur. You'll find setting up y...